This article was originally written by me and published on the Hummingbot Blog

Welcome to Hummingbot Academy!

If you reached this page, there is a high probability that you have been asking one of these questions:

- What is a market maker?

- What do market makers do?

- How can I become a market maker?

- How do I create a market making robot?

Then you are on the right place!

Here at Hummingbot Academy, our goal is to help you learn more about market making and how to use our free open-source robot to implement your own strategy.

But what is a Market Maker?

A market maker (MM) is a firm or individual who actively quotes two-sided markets in a security, providing bids and offers (known as asks) along with the market size of each. (source)

If the above quote didn't made any sense for you, imagine a pawnshop:

Image credit: Steve Sutherland

Let's say that Susan has an old guitar, doesn't have much time to play anymore, and can use some cash; meanwhile, Mike has been learning to play his friend's guitar and now thinks that he is good enough to invest some cash to buy his own, but a brand new one might be too expensive.

Although we have two people that could close a deal, it might be difficult for them to find each other, or even to agree on a reasonable price for that guitar.

This is where the pawn shop enter the picture:

Instead of looking around for someone that wants to buy a guitar, Susan could sell her guitar to the pawnshop, and Mike could go there knowing that he would find one.

The pawnshop owner is providing a service to both Susan and Mike. He offers an easy way to sell/buy what they want (providing liquidity) and a fair price, based on the demand for used guitar in the town (spread reduction).

The pawnshop will be paid for this service by the difference in price he paid to Susan and the price he received from Mike (spread size).

A market maker, like a pawnshop owner, provides the same kind of service in financial markets. He provides liquidity and helps to reduce bid-ask spread sizes, taking his profits from the difference between his buy and sell orders (spread).

How does market making happen in financial markets?

A financial market isn't much different from the real economy open markets. Every day, millions of people access some kind of trading platform, looking to close deals among a wide range of assets, including company shares, bonds, oil, gold, contracts, and cryptocurrencies.

But instead of thousands of people gathering in the same place, holding signs and/or screaming for how much they are buying or selling something, financial assets markets use an order book, where all buy and sell offers are aggregated in the same place:

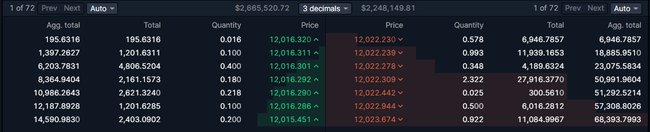

Source: Bittrex

The order book is nothing more than a list of all buy and sell offers (with quantities and prices) available across all market participants.

In the picture above, we can see the BTC/USD pair order book. If someone is looking to buy Bitcoin right now, he/she will have to pay $12,022.230 (the lowest ask price) and there is 0.578 BTC available at that price.

But if someone wants to sell Bitcoin immediately, he/she will have to accept the price of $12,016.32 (the best bid price) for up to 0.016 BTC.

The difference between the lowest of offer prices and the highest of demand prices for a good or asset is called spread.

Technically, any person that posts a buy or sell offer on the order book is acting as a market maker, while those who are accepting the prices offered on the order book is called a market taker.

Acting as a market maker is conceptually similar to participating in the market as the "pawnshop owner", creating offers to buy an asset at a low price, and selling it at a higher price as fast as possible and as many times as possible.

While the most common trading/investing strategy looks to profit from big price changes, a professional market maker is trying to capitalize on smaller but more consistent price swings between two price levels.

Most traders and investors want to see the market moving like this:

While market makers love to see market prices moving like this:

The price of an asset doesn't change at a constant flow but as waves, and while traders and investors are trying to find out if the sea is moving towards high or low tide, the market maker is watching the smaller waves on the beach.

Bid-ask spread vs market maker spread

(To keep reading this article visit the Hummingbot blog.