(Note: This article cover a lot of details about the blockchain i am talking about. If you are only interested on how to Stake/earn interest, just jump to the end of the article)

As i wrote on my previous article about how some ways to increase your BTC holdings, the possibility of receiving interests on whatever crypto you hold/like is a really interesting prospect that is on a rising trend on the cryptocurrency world.

Besides lending crypto, i dare to say that the first step toward this this new wave of crypto-investment was the start of proof-of-stake models.

And as anything else on the cryptosphere, there is a lot of projects and options and they all have similarities and differences.

Therefore, i am going to explore some of these coins, trying to understand what is the project about, and how profitable it can be to invest, and how you can do it.

And again, a warning: Cryptocurrency investments is a high risk business, so don't put your money anywhere, unless you know what you are doing, and have a high risk tolerace.

The Project

Website: https://blocknet.co/

Whitepaper: https://docs.blocknet.co/project/blocknet-whitepaper.pdf

Twitter: https://twitter.com/The_Blocknet

Start Date: 20 October 2014

Development status: On-going

Consensus Mechanism: Proof-of-Stake

Algorithm: Quark

Token: BLOCK

Blockcain Explorer: cryptoID

Opensource

The creation of Bitcoin opened a door that probably won't ever be closed:

After Bitcoin reached some popularity, we all know the results: Thousands of projects were created aiming to bring decentralization and blockchains to every kind of economic activity.

But this direction created a new problem: With thousands of different blockchain protocols trying to achieve a different objective in different ways, how would be possible to make a fully functional economy based on blockchain?

This situation created a race (among others) to create a product that allow all the different blockchains to interact between each other, while still being totally independent.

And this is where BLOCKNET project comes in. As described in their own website:

Blocknet is a blockchain interoperability protocol that enables communication, interaction, and exchange between different public and private blockchains, as well as on-chain access to off-chain data, APIs, and services via oracles.

You can read their very detailed whitepaper, whare you can find how they plan to achieve this idea, including all the technical details about how their project would work.

Project Status and Products

With 5 years of existance, BlockNet already have working product, with it's open source code available on their github page.

Working on a Service-based model, they have 3 main components to keep it all together:

- XRouter: Allows applications to interface with blockchains

- XBridge: Allows any application to perform decentralized exchanges

- XCloud: Allows applications to run entirely decentralized by enabling onchain use of off-chain data, APIs and services.

BLOCK DX - Decentralized Exchange

But the main working product the BlockNet Project have right now is its DEX (Decentralized Exchange).

On a centralized exchange like Binance, you allow a centralized entity to have custody of your funds, which goes a bit agains the concept created by the cryptocurrency tecnology that you are the only one that can move your funds (as long as you are the only one holding the private keys).

Therefore, there is a lot of projects trying to create a decentralized exchange, where the users can trade their assets directly from thier personal wallets.

There is a lot of options and models available these days, and each of them have their own issues, and Block DX is aiming to solve them, creating, as they describe, a "4th generation DEX — Currency Agnostic / Fully Decentralized — Protocol Based: Not limited to specific blockchains." (Check this article where they explain more about this concept).

One of their main sell points is that their protocol allows anyone to trade their crypto assets directly from their personal wallets, without the need to do any extra action, like "wrapping" a token.

Their app work as a point of network connection, where market users put their orders on the book, but the settlement happens directly between the traders wallets.

Another really interesting feature is the possibility to create any trading pair order, as long as they are listed on the platform (here is all the supported assets). Want to trade LYNX/LBC? Sure. How about GALI/DGB? Yes you can.

You can check all the features their DEX offer here.

My personal opinion is that, so far, this is one of the best decentralized exchanges concepts i have stumble upon, but there is still a lot to improve.

There is two main issues i think are big problems to reach a mass adoption:

1 - It's a bit complicated to start using

In theory, it is easy, but there is a lot of steps you need to go throught to install and start using the exchange, as you can see on the video below.

2 - You need to have the full wallet of the asset you want to trade on your computer

That means that you must have the full core wallet, and the whole blockchains data stored on your computer. This make thing a bit hard for traders, because they will need a lot of storage space to be able to trade a lot of assets (for example, the whole BTC blockchain is 280GB).

And less traders/market makers means a lower liquidity on the market.

The token and it's uses

- Ticker: BLOCK

As any other blockchain, BlockNet uses it's own token to process transactions, rewarding those that have implemented nodes to secure the blockchain.

Besides that, the token is also used to pay the trading fees of the BLOCK DX exchange:

Maker Fee (Creating an order on the book): free

Taker Fee (Accepting an order from the book): 0.015 BLOCK

100% of the trade fees generated on BLOCK DX are distributed to the network Service Nodes

But keep in mind that, since the settlement of the trades happens through directly transfers between users wallets, there is also the network fee of each cryptocurrency you trade.

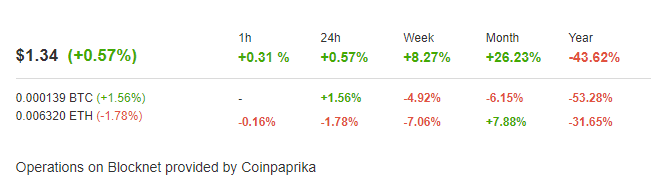

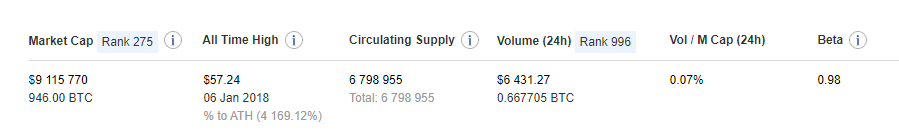

Market Overview (05/19/2020)

Price Overview

Source: Coinpaprika

YTD returns

(Blue: BLOCK;Red: BTC)

Exchanges

STAKECUBE

BLOCK DX

Altilly

VCC Exchange

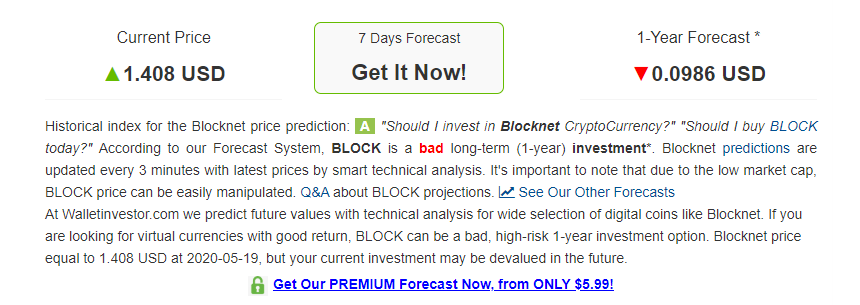

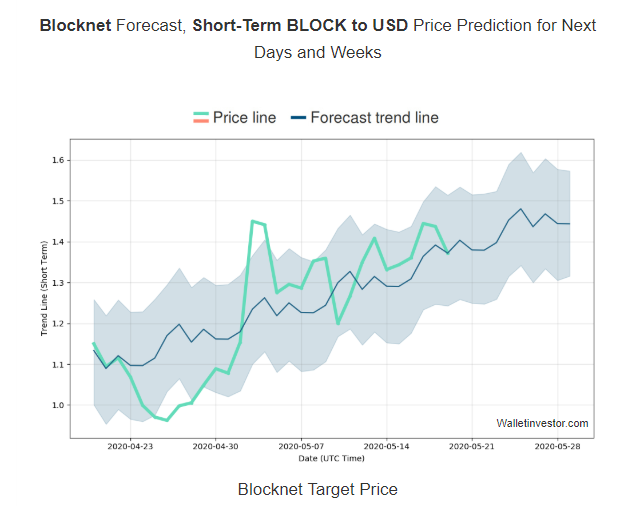

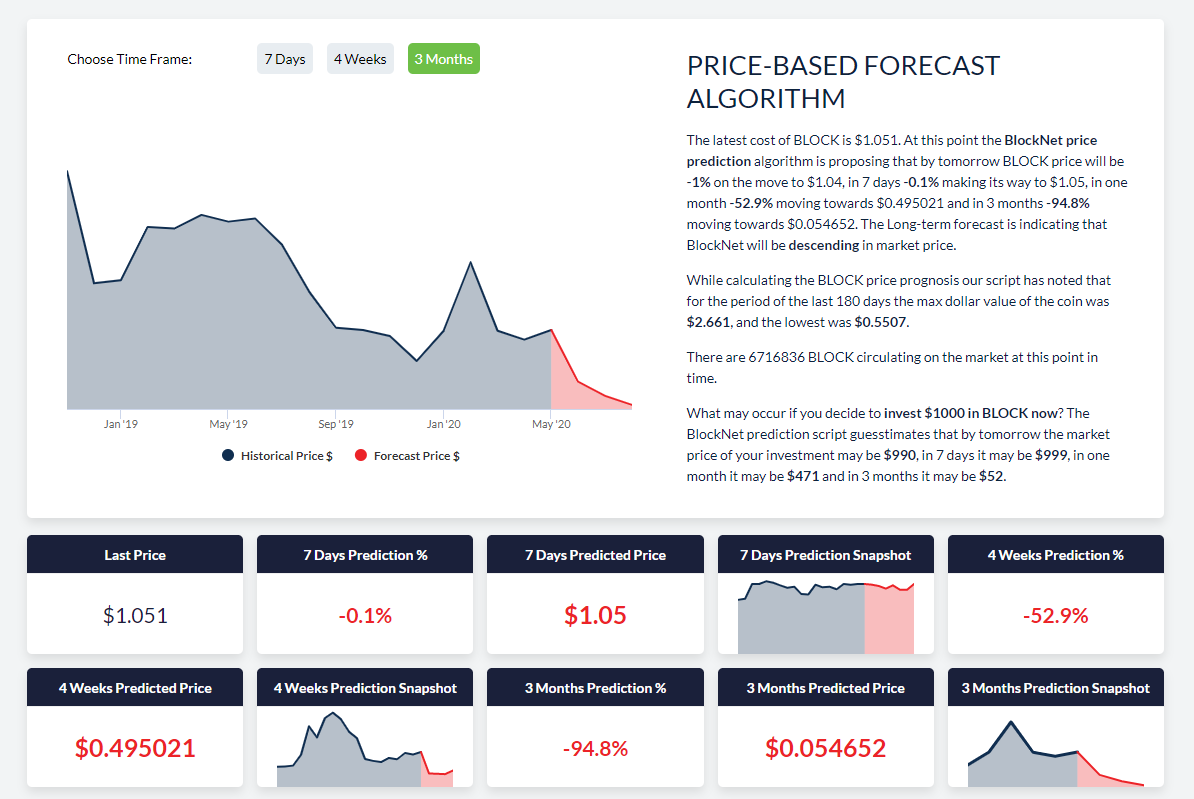

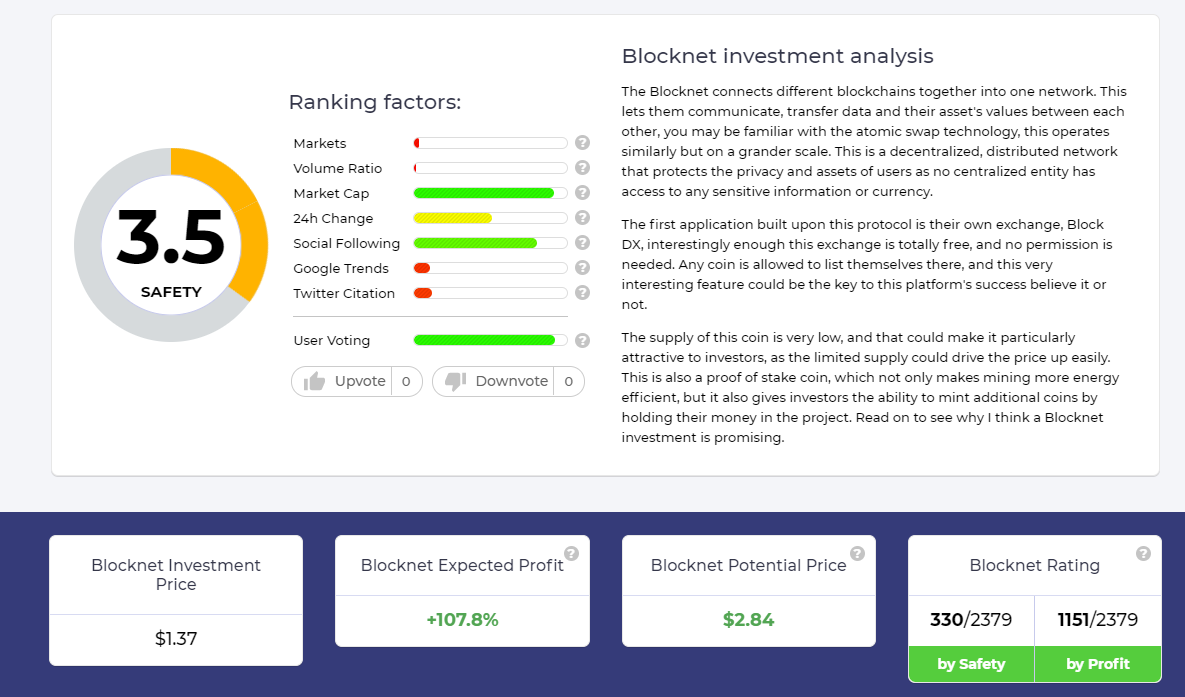

Algorithm Forecasts

There is a few websites that provide a price prediction of an asset using algorithms based on past movements of the price.

While they provide an interesting information, it is always advised to use this information with care, mostly because past behavior doesn't guarantee future results.

Here is some of these predictions.

Wallet Investor

1 year forecast

7 day forecast

Coinpredictor

Cointobuy

Staking/Interest

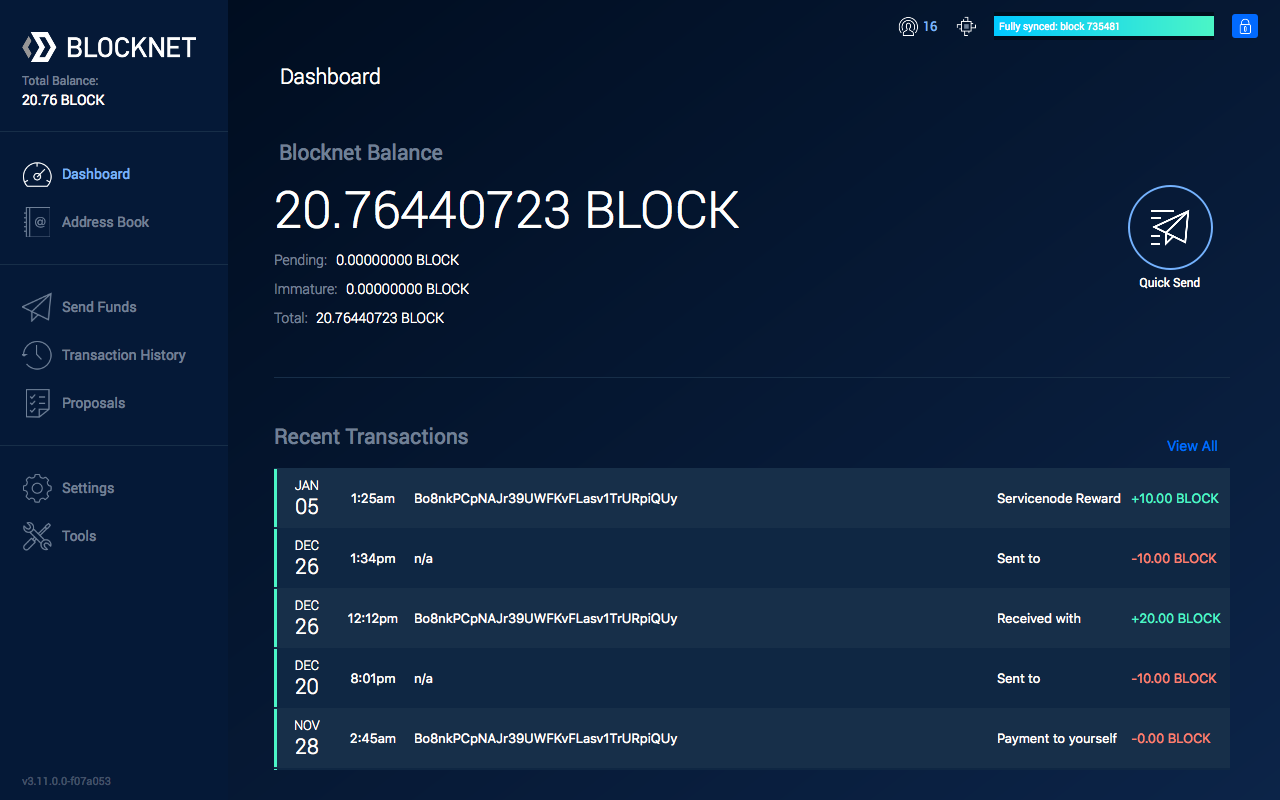

As a proof-of-stake coin, BLOCK allows it's users to participate on the network securit by staking the coins, for a chance o being selected to proccess a transaction and be rewarded for it, increasing the amount of coins you own. There some possible ways to do it, each with it's pros and cons.

Here is how you can Stake BLOCK

Wallet Staking

It is pretty simple. Deposit BLOCK on your wallet, and activate the staking. Here is a complete guide.

When you stake directly in your wallet, every time a new block is created on the blockchain, everyone that is participating on the staking have a probability of being selected based the size of the stake proportional to the total coins staked.

For example, if you are staking 100 coins, and there is 10000 coins in total staked on the network, your chance of being selected to process the block is:

(100/10000)*100 = 1%

Now, the only problem is: Your wallet must be open everytime you want to stake your coins. If the wallet is closed, you won't be connected to the BlockNet network, and won't have a chance at being selected as block validator.

Minimum funds to Stake

There is no minimum. But the more you have, the better your chances

Expected Profitability

It's a bit tricky to calculate the Profitability/ROI, because you need to know how much time your wallet will be open and connected to the network.

Here is how you calculate it:

ROI = ( (Total Blocks recognized) / (total block staked on the network) ) * 100

For reference, we will be using a full year where the wallet would be connectec 24 hours every day.

The network produces 1 BLOCK every minute, therefore:

1 BLOCK/min * 1440 min/day * 365 days/year = 525600

Checking on the blockchain explorer you can see how much BLOCKs is being staked on the network.

Right now, there is 2881856.3844 BLOCKs being staked

So, the ROI will be:

ROI = (525600 / 2881856.3864)*100 = 18.23%

What this means is that for each 1000 staked BLOCK, you would receive 182.3 BLOCK every year of staking.

If you want to have a better estimate, use this calculator

Service Nodes (Masternodes)

Services nodes is a bit more technical to implement, and you can check here how to do it.

I won't be covering in details here, because besides the technical side of setting up a masternode, you must also consider the costs of doing so.

But here are the basic requirements:

- 5000 BLOCK as collateral

- 2 computers

- Internet connection

The advantage of setting up a service node is that you can still Stake the 5000 BLOCK used as collateral, and also can receieve a payment of 0.015 BLOCK payment for each trade settled on the BLOCK DX exchange.

These fees are distributed at random to all active Services nodes.

Staking Pools

Now here is where things get interesting for those that don't have the technical knowledge, nor the possibility of have a computer turned on 24 hours per day to have a good chance at staking directly on their wallet.

Some sites provides what is called Staking Pools, where a central entity set up a staking wallet or masternode, and anyone can get a "share" of the staking/masternode.

There is a lot of Staking Pools around for every coin, and before trusting your money to any of them, be sure to check around to see if the pool can be trusted, after all, you are putting your funds under that entity custody.

The pools also collect a fee for the service provided, which means that you will always have a lower return than staking directly on your personal wallet.

On the other hand,the big advantage of being part of a staking pool is that usually, due to the size of the stake these pools hold, a daily staking return is almost guaranteed.

Also, you don't have to have a computer on 24 hours per day to receive the staking rewards.

Related to BLOCKNET staking, my preferred Staking pool is STAKECUBE, which doesn't require any minimum amount to start staking and have an integrated exchange.

The expected Annual ROI of BLOCKNET on STAKECUBE is 4.64%

Conclusion

As a project, i see a lot of potential on BlockNet, specially because the interoperability of blockchains and decentralized exchanges will be a major factor that will play a big role on the evolution of anything related to crypto.

While there is a lot of competition on this area, BlockNEt development seems to be going at full force, and the model of decentralized proposed by the project, in my opinion, is one of the best i have ever seen so far. The only problem is the same as any other crypto project: It's hard to understand and use.

If the team are able to make big improvements on the user experience area, they might have a really awesome product in hands.

See ya!